Building Your Credit Score: The Right Way to Use a Credit Card

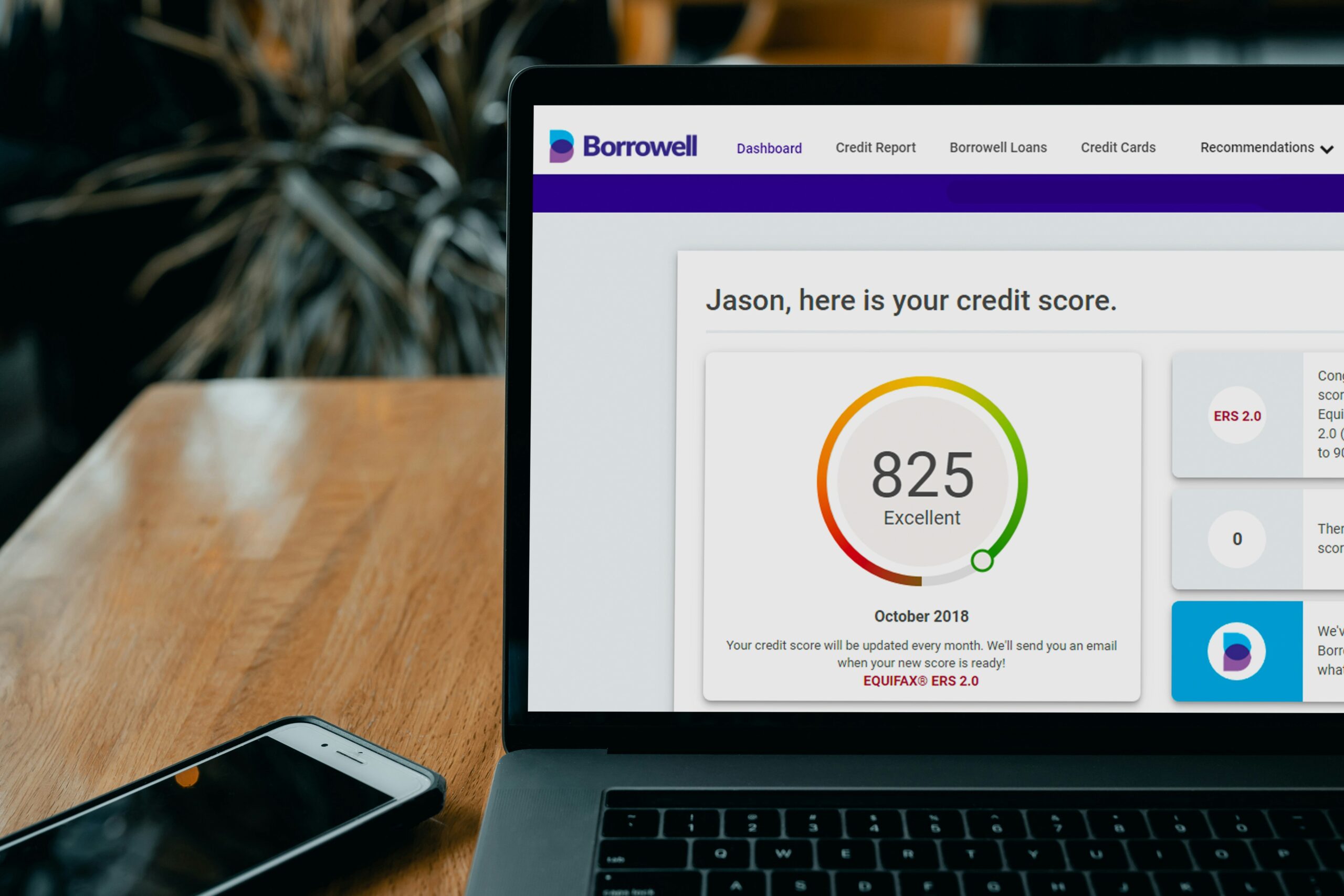

Understanding Credit Scores and Their Importance Credit scores are numerical representations of an individual’s creditworthiness, reflecting their ability to repay borrowed funds. Typically ranging from 300 to 850, these scores play a vital role in financial transactions, influencing decisions made by lenders, landlords, and other entities assessing credit risk. Credit scores are primarily calculated based … Read more